Bluehost: eCommerce Statistics and Trends for 2023

Before the global health crisis, shoppers favored physical stores for instant gratification and tactile product experiences. But the pandemic changed all this. Lockdowns fueled a surge in online shopping, even among older consumers new to the digital market.

After lockdowns were lifted, buyers returned to stores mainly for online pickups. And while brick-and-mortar shops did regain some of their former foot traffic, 90% of Americans now primarily use eCommerce for shopping.

This overview of 2023 eCommerce statistics will help expand your understanding of the online shopping landscape and inform your business strategy.

Let's explore the business, sales and market impact of current eCommerce trends across product categories, demographics, regions, payments and technologies.

Benefits and drawbacks of eCommerce

The pandemic sped up eCommerce adoption, and now it lets us reach people globally, saves money and is easy to use for consumers. But there are drawbacks.

Security can be a problem. There's no face-to-face contact. Customer service can get tricky.

Recognizing the benefits customers seek and addressing their concerns is paramount for growing your eCommerce business.

In a 2022 report, 45% of respondents cited "flexibility to shop at any time" as the top benefit of eCommerce. Next on the list was finding better prices, which shoppers said was a critical motivation for buying online.

Most other shoppers valued some form of convenience:

- 22% preferred shopping across locations

- 25% researched products and reviews

- 26% used eCommerce for easy product search

- 34% wanted more product variety

- 36% wanted to avoid physical stores

eCommerce market size

In 2023, global eCommerce will make up over 21.5% of total retail sales at $6.15 trillion, a $600 billion rise or 11% increase from 2022. By 2025, eCommerce will account for 23.6% of sales, reaching $7.39 trillion.

Southeast Asia, India and Latin America have the highest eCommerce sales growth rates.

eCommerce sales and revenue statistics

Asendia reports that 2021 retail eCommerce sales were approximately $4.9 trillion worldwide. This figure is estimated to reach about $11 trillion by 2025.

The data shows positive growth, but you might have questions like "What regions and eCommerce platforms have the highest growth rates?" and "What products are driving the most sales?"

Understanding the sales numbers and what drives them can help you position your eCommerce store for success.

Online marketplaces dominate the eCommerce space

Online marketplaces earned $3.24 trillion in 2022. Amazon, Tmall, Taobao and JD.com dominated, holding 77% of the top 100 marketplace sales in 2023.

But don't run away with the idea that only big marketplaces benefit from all that revenue. Third-party Amazon sellers get the larger slice of the pie, earning $0.54 per $1 shoppers spend.

The U.S. International Trade Association (ITA) states China accounts for almost 50% of global eCommerce, and in 2021, China's online sales surpassed the U.S.'s at $1.5 trillion.

Despite challenges in 2022, China's eCommerce is projected to grow 9.3% in 2023, reaching over $3 trillion by 2024. Insider Intelligence predicts no country will match even half of China's sales that year.

Despite China's sales dominance, Amazon was the top consumer online service company in 2022, valued at $857 billion. In 2023, its market cap reached $1.43 trillion and has hovered at over $1 trillion throughout the year.

Screenshot: Statista

Alibaba trailed Amazon with a $233 billion valuation, which grew to $317.33 billion in 2023.

Alibaba leads in several eCommerce sectors, with projected sales of $461.9 billion by 2027. However, Amazon might exceed that with a projected 2027 revenue of $518.9 billion.

As the previous eCommerce statistics we've looked at have shown, the pandemic lockdowns boosted online shopping activity.

From May 2021 to April 2022, Amazon saw 15.8 billion monthly desktop visits. Statista reported 3.16 billion unique visitors to Amazon in 2022, with eBay in second place at nearly 590 million visitors.

Screenshot: Statista

eCommerce sales differ by product type

In 2022, U.S. eCommerce spending focused on computer electronics, apparel (including jewelry) and furniture, with expenditures of $219.33 billion, $203.75 billion and $129.45 billion, respectively.

Screenshot / Source: Insider Intelligence

Computer electronics and apparel comprised 21.2% and 19.7% of U.S. eCommerce spending, exceeding 40% combined. Plus furniture, the top three categories account for over 50% of retail sales across categories.

Global online shoppers averaged $2.3 per visit in Q1 2023. Luxury apparel led global sales at $2.71 per visit, followed by home furniture, slightly above $2.5.

U.S. and global shopping behaviors are aligned, favoring apparel and accessories and home furniture.

Insider Intelligence reported automotive, food and apparel as the fastest-growing categories. Automotive sales rose by 30.1% in 2022 and are projected to grow by 18.8% in 2026. Food and beverage grew by 20.7% and is estimated to rise by 16.3% in 2026.

Apparel's growth declined from 15.4% in 2022 to 14.6% in 2023. By 2025, both apparel and health, personal care and beauty are predicted to grow by 14.1%. In 2026, apparel's growth is expected to decrease to just 13.4%, while the health, personal care and beauty category is anticipated to fall to 13.9%.

Screenshot / Source: Insider Intelligence

Commerce buyers prefer to pay digitally

Screenshot / Source: FIS Global report

In the 2023 FIS Global report, digital wallets comprised 49% of global eCommerce transaction value, while credit cards followed at 20%.

In the U.S., digital wallets account for 32% of eCommerce sales, ahead of credit cards at 30%, with the top options being PayPal, Apple Pay and Google Pay.

However, PayPal transactions fell year-on-year to nearly 12.9% in Q4 2022 and made marginal gains in Q1 2023 to reach 13%.

A 2023 global survey found that 55% of eCommerce users wanted better, seamless payment methods, which seems to be driving digital wallet adoption.

eCommerce conversion rate statistics

Impulse buying drives eCommerce conversions. In a Statista report, 57% of women and 38% of men worldwide bought shoes or clothes online on impulse.

However, while 49% of men bought electronics on impulse online, only 27% of women did the same.

Screenshot / Source: Statista

Electronics, apparel, furniture and beauty will lead eCommerce sales till 2026, possibly because they also have the most impulse buy rates.

While the food and beverages category has fewer impulse buyers, it tops Q1 2023 eCommerce conversions at 3.1%. Health and beauty followed at under 3%, beating the 2% eCommerce industry average.

Q2 2022 data shows device and screen size affect conversion rates, which fall as screens shrink.

eCommerce returns are inevitable

A 2023 study showed that online shoppers return items three to four times more often than in-store shoppers. But, many eCommerce stores think this is normal and do nothing to fix it, so only 19% of retailers have a strategy to handle returns.

Narvar reported that fit and size issues are two of the most common reasons for eCommerce returns, amounting to 42% of online returns.

Customers often use product photos, descriptions, reviews and, more recently, fit tech to avoid returns. Narvar's report shows that 88% of customers who returned products for fit issues had used these tools but still returned them. However, 58% of shoppers who used augmented reality (AR) said it helped prevent them from having to make a return.

Source: Bluehost

Cover photo: Salesforce

How a small business can benefit from an online presence - Blog

Unlock E-Commerce Simplicity with ECWID stores: Perfect for Beginners! - Blog

16 reasons why your business needs a website - Blog

ECWID: 15 Steps to opening an Online Store - Blog

Blendtec - A great example of building a strong online presence and brand awareness - Blog

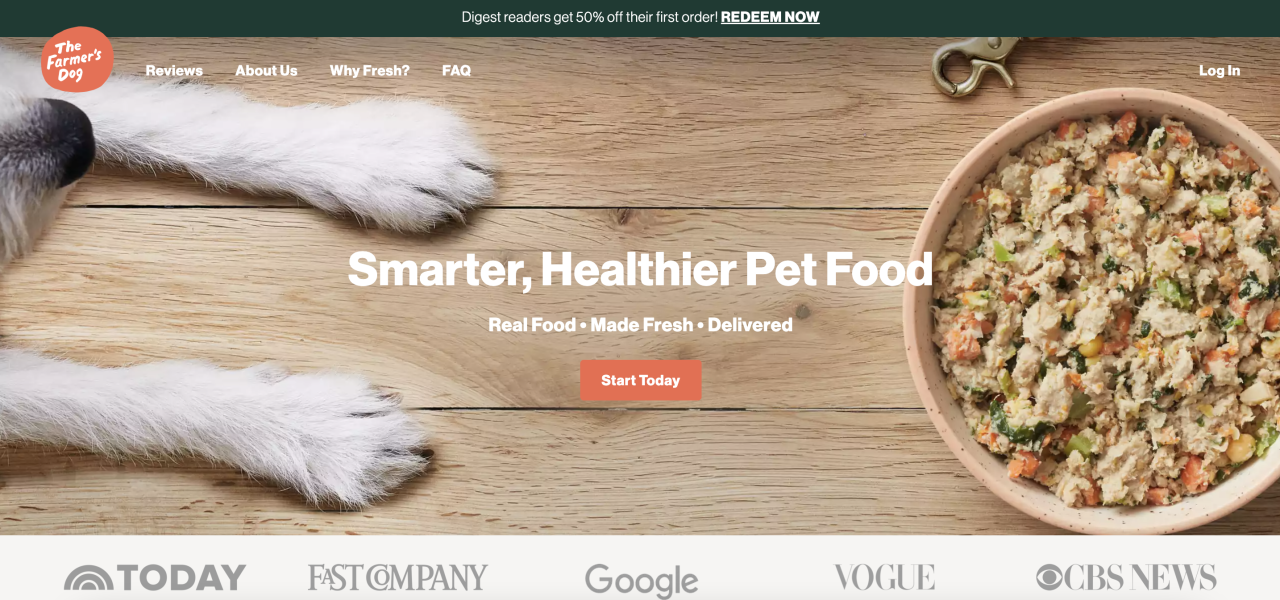

Optimonk: 14 Ecommerce Case Studies to Inspire You - Blog

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.